Quick Intro

PubMatic is a digital adtech company with a supply-side platform (SSP) that serves publishers by listing their ad space to potential buyers. Publishers are online content creators and websites that provide free content to the public. The reason they are able to keep content free is because they sell advertising space on their web pages, videos, or articles (examples: IGN for video gamers, yahoo finance for investment news, etc.). PubMatic is an omni-channel platform so they are able to provide support to creators in all content formats (video, mobile app, and web).

In almost any industry, there is room for a middle man, and this is where PubMatic fits in. They facilitate the selling of ad space and the market place transactions between buyers and sellers. This enables content creators to focus on what they do best: create content.

Business Fundamentals & Financials

The Business

PubMatic is a founder(s) led small cap company with a long term strategy to grow organically and conservatively. PubMatic is a necessary partner for publishers across the globe. Their OpenWrap platform helps publishers list their ad inventory and integrate with ID solutions (via Identity Hub) to properly tag their audience. Buyers use ID solutions on their end to match the inventory they are bidding on. Identifying the appropriate audience is just one way PubMatic aims to increase return on ad spend. There are other features in the platform like AB testing, performance analytics, legal and compliance resolutions (different rules in different regions), etc. Alternative ID solutions are important now as we are entering a post-cookie world and protecting consumer privacy. More on this in the “Landscape & Competitors” section.

There is another big push in the digital ad space: supply path optimization (SPO), where ad inventory is filtered to serve only the highest quality. PubMatic enters in 1-year agreements with DSPs1, advertisers, and agencies that allows them to buy ad inventory from their platform. The contracts automatically renew and the goal is to negotiate terms that increase their ad spend on PubMatic’s platform. More on SPO in the “Competitive Advantages” section.

Advertising is annually cyclical so investors should expect higher volume in the second half of the year. The higher volume taps into their operating leverage which provides much higher profit margins in H2 vs H1.

The business is diversified across many regions and many industry verticals, so there are few customer, sector, or region risks. The highest customer concentration in 2021 was 17% of total revenues, down from 28% in 2019.

US revenue made up 62% of total revenue in 2021. EMEA revenue tripled since 2019.

Financial Performance

Q2 2022 marked their eight straight quarter of 20%+ YoY growth and 13th straight quarter of positive GAAP net income. They slightly dropped their FY22 revenue guide by $5M but increased their EBITDA guide by $2M (38% margin). This showcases their cost discipline. They currently have a 130% net retention rate, which means clients on average spent 30% more with them this year than last year. They ended the quarter with $183M in cash and no debt (the cash balance will be lower given a $45M acquisition in Q3, more on this in next section).

Their ROIC ranged from 19% to 27% since their IPO in Dec 2020.

They have a record of setting modest guidance and typically beating.

I expect continued strong performance and consensus beats moving forward.

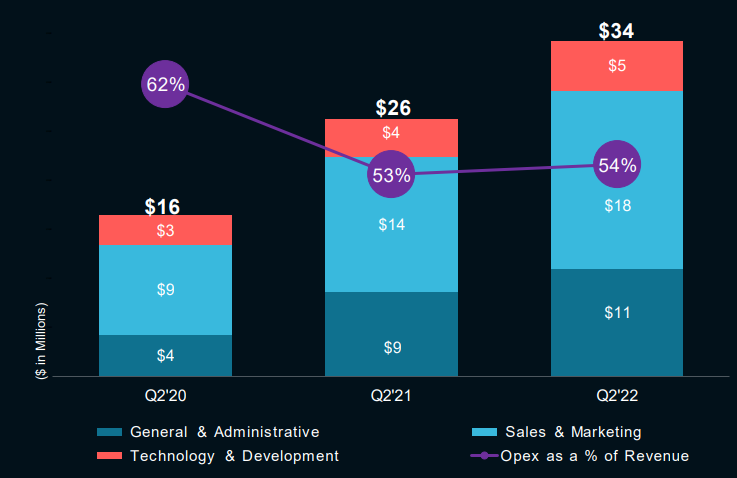

PubMatic has 70%+ gross margins and nearly 40% Operational Cash Flow margins. Recently, just half of OpCF was converted to Free Cash Flow, but that was partly due to CapEx investments in their network infrastructure. They pulled forward CapEx in 2021 to avoid supply chain issues. I believe as their hardware requirements are met, less CapEx will be required and FCF will approach OpCF. They are now focusing less on CapEx and more on OpEx by aiming to double their engineering headcount. The founders are Indian-American and often hire in India, which is cost-effective labor. They have been in a strong growth mode and India-based engineering headcount increased 37% in the last 12 months. The team is growing in line with revenue:

Competitive Advantages

Owned Network Infrastructure

PubMatic management realized early on that their compute needs were going to explode exponentially. They need to process trillions of ad placements a year, and several for each bid. Instead of using the typical solution of outsourcing to a 3rd party like AWS, they decided to build out their own servers. This provides them with a hefty operating leverage piece in comparison with competitors. They have control over the hardware which means they can buy servers that meet their exact performance needs and not pay an arm and a leg for it. Of course, maintenance and growth has its expenses, but check out the operating leverage they’ve achieved:

This is my favorite graphic. They’ve nearly quadrupled the number of ads they process while halving the cost to process each impression. As they grow, this will become increasingly important for having superior margins to competitors and in improving their supply path optimization (SPO) offering.

Data and Machine Learning

PubMatic processes hundreds of billions of ad impressions daily. They know many features about this ad impression including:

the information on the user from the 1st party publisher, like device, location, page URL, etc.

whether the user was a recent shopper for X product

how much advertisers were willing to bid for this impression

PubMatic feeds this data into their machine learning models in real-time to modify pricing of high quality ad inventory, increasing yield for publisher partners.

Their machine learning algorithms also predict which bids will be higher quality vs lower quality and chooses which to process and present to the buy-side. This is likely a factor in their SPO offering.

SPO

Supply path optimization (SPO) is a strategic initiative PubMatic is investing in. Though they’ve been growing organically, they actually acquired a tiny company Martin for $45M total ($26.5M up front) this week; their last acquisition was in 2014. The acquisition is a synergistic move to enhance their SPO offering, which provides a strong moat for their business. SPO is intended to ensure that marketing dollars are spent efficiently, e.g. they go to the right audiences and avoid fraud bids on the platform. Essentially SPO acts as a filter. Here’s a quick video from PubMatic illustrating what SPO does. SPO is a major concept at play, because it will naturally consolidate smaller players in the ad space that cannot provide this. SPO now makes up 30% of PubMatic’s revenue (was 24% in Q2 2021). It is likely that it continues to increase to a larger percentage of total revenues as companies wish to avoid wasting marketing dollars on poor performance. A major reason why I believe PubMatic will succeed in SPO is because of their ability to process an increasing number of ad placements with their owned network infrastructure. This will allow them to determine which bids are higher quality than others and serve only the highest quality.

Management

PubMatic was founded in 2006 by 4 co-founders:

Rajeev Goel, CEO

Amar Goel, Chairman & CIO

Mukul Kumar, President of Engineering

Anand Das, former CTO and Advisor. Recently left to focus on several other concurrent endeavors

Rajeev and Goel grew up in San Francisco, where both of their parents worked at tech companies. They started a golf e-commerce website back in 1995 and achieved a $30M run-rate at a young age.

Rajeev and Amar are brothers and are major owners of the Class B shares which control most of the voting power. Here is a breakdown of insider ownership as of April 2022, per annual proxy statement.

Rajeev and Amar control 63% of the total voting power. While some may perceive this as a potential governance issue, I see it as two brothers who spent nearly two decades building a company who don’t want to see it derailed for short-term goals. Note that a couple early VCs (Gupta Trust and Helion) still hold >5% of the company.

Rajeev mentioned on many conference calls that he aims to 10X their market share over time. They used to have 2% market share of the ad market outside the “walled gardens”2 with a goal of achieving 20%. In the last year, that 2% market share increased to 3%. They are delivering by growing faster than the industry average, implying taking additional market share.

Glassdoor

PubMatic has solid reviews on Glassdoor, though the metrics are down from the mid 90%s late last year. This seems normal for companies who are growing. The written reviews are all mostly positive.

Landscape & Competitors

Digital Ads

The global digital ad TAM is growing from $566B in 2022 to $700B+ in 2025. This statista article gives some notable figures on the state of the digital ad market:

70% of the total digital ad spend is outside the US, and PubMatic serves many international clients. They have offices and sales staff dispersed across many countries in Europe and Asia. Recently they were selected by GroupM for a partnership in EMEA.

Ads will continue to go digital. Digital ads will continue to go programmatic.

$11.4B Ad Fraud in US means there will be increased demand for SPO solutions to make sure marketing dollars are spent efficiently.

IDFA and Cookies

Apple’s IDFA threw a wrench in many ad-dependent companies like Snapchat, Facebook, and others. This had minimal impact on PubMatic for two reasons:

Majority of their revenue is derived outside iOS

Google is not deprecating cookies until 2024

Their cookieless solution (partnership with LiveRamp) is performing better than the cookie solution

Cookieless solutions include leveraging broadly used alternative identity solutions like LiveRamp’s Addressability (or TheTradeDesk’s UID 2.0) via PubMatic’s Identity Hub

PubMatic works with publishers who own the 1st party relationship with their user. I believe long term this will become increasingly important since they have data on their users (vs 3rd parties who are no longer allowed to collect info).

CTV

CTV is by far the fastest growing segment in the industry, and while PubMatic is growing fast in this segment (150% YoY), the revenue isn’t broken out, which may imply it is small. They are popular in other content formats that drive the business, but CTV provides optionality not reflected in today’s valuation. With companies like Disney and Netflix building out ad-tiered subscription models, this will become an increasingly important place to participate in order to outpace current growth expectations. They believe CTV, like everything else, will go to header-bidding (programmatic advertising), but it is yet to be seen. If the industry makes that change, I am confident they will be leading the charge among SSPs.

Competitors

Their largest competitor is Magnite (ticker: MGNI). They have grown primarily inorganically through M&A. Their organic growth is low and their financials are messier. The company is not founder-led, and they are riddled with debt from acquisition. They drive notable cash flow from operations, but until the debt is paid down, I don’t see cash returning to shareholders. A big strength that Magnite has compared to PubMatic is that they have a notable percentage of revenue (~40%) attributed to CTV. Since CTV is the fastest growing channel in the industry, this is a big advantage and PubMatic is playing catch up.

Not really a competitor, but TheTradeDesk3 (ticker: TTD) recently released Openpath, a platform for publishers to list their ad inventory directly to TheTradeDesk and bypass SSPs. This could seem a bit hostile toward SSPs, but Jeff Green (TTD CEO) has said several times he does not plan to get involved on the SSP side and he serves the buyer first. He will not offer publishers any yield management service, and integrating an in-house technology is probably something out of the scope for majority of publishers. Openpath is intended to provide buyers more visibility into what adventory they are bidding on rather than going through an SSP which could be more convoluted. I personally don't find much risk here for PubMatic just yet, but TTD is a formidable company and should be watched closely.

Stock Performance and Valuation

The stock is down 38% since its IPO in Dec 2020 (down 74% since peak in Feb 2021). Meanwhile, PubMatic’s EPS is up 307% and revenue up 98% in the same period. Shares outstanding is up 10% in the same period; this makes sense given the increase in headcount.

Comparing the ownership table from the 2022 proxy statement (Management Section) to 2021’s proxy statement (below), majority of early VCs exited the stock after the lock-up period. This likely put a lot of downward pressure on the stock over the last year and implies there’s less overhang now.

Also, PUBM had 45% late last year to now 60% institutional ownership. It has been an easier stock to short, which likely put more downward pressure on the stock. I believe as more institutions take a position, this will fix itself. Ultimately, I believe that the flows negatively impacted the stock thus far and it can play a positive role in the other direction moving forward.

Valuation

$105M FY22 EBITDA

$890M market cap

$180M cash and no debt

Can deduct $26.5M up front payment for Martin acquisition in Q3

We get EV of $736.5M ($890M -$153.5M), which means today you are buying the company at a 7x EV/EBITDA. For a company with 20% growth projections for years to come, that looks pretty cheap. Compare this to the DSP leader (TTD) which is somewhere in the 300s. SBC is also not as outrageous as other high growth tech companies.

Summary

PubMatic is a fundamentally strong SSP led by disciplined founders and management. They aim to grow profitably, cost-efficiently, and through methods unincorporated by competitors (owned network infrastructure, workforce in India). The digital ad TAM is expanding which provides growth, alongside the company increasing market share by consolidating smaller players out of the space. There are several factors to why smaller players will be consolidated out:

they are unable to provide SPO

they have not reached critical mass to scale costs

publishers will want to consolidate SSPs for operational efficiency

CTV optionality is not reflected in today’s valuation and rightfully so since the company has not made big strides here yet. With new ad-tiered subscription models in place at Disney and Netflix, PubMatic’s participation can provide higher growth than forecasted.

Just with the current business model and landscape, I believe PubMatic can grow 20%+ profitably for years to come, with optionality to grow above this. At the current market price, I believe PubMatic provides great value and a long streak of strong performance to come. They will continue to fortify their position as a leader in the SSP space and grow their market share to the goal of 20%+.

Disclaimer: I do not guarantee the accuracy or completeness of the information provided in the newsletter. All statements express personal opinions based on my own financial and business analysis. Any estimates or forward looking statements made are inherently unreliable.

The content of my newsletter is not a trading or investment advice. The information provided should not be considered as a specific advice on the merits of any investment decision. Securities trading involve risk and you might lose your capital and/or incur other damages. Investors should make their own research and consult their registered investment advisor or financial advisor before taking any investment decision.

DSPs are demand-side platforms. They represent the buyers (advertisers) in the bidding process.

The “walled gardens” are platforms like Google Search, YouTube, Facebook, Instagram where external parties are not allowed to participate in the market place. These companies run their own market place and have their own DSP and SSP in place

TheTradeDesk is the largest DSP outside the “walled gardens”

Nice weite-up!